- 澳大利亚AFSL

- 新西兰FSP

- 英国FCA

- 美国NFA

- 瓦努阿图VFSC

- 塞浦路斯CySEC

- 伯利兹IFSC监管牌照

- 澳大利亚ASIC监管

- 海外银行牌照

- 塞舌尔FSA监管

- 美国MSB支付及换汇牌照

- 申请加拿大MSB牌照

- 美国MSB牌照、数字货币交易牌照

- 马来西亚纳闽LabuanFSA牌照

- 马耳他MFSA牌照

- 澳洲ASIC AR牌照

- 美国SEC RIA投资顾问牌照申请

- 澳大利亚AUSTRAC数字货币牌照

- 爱沙尼亚MTR数字货币牌照

- 办理新加坡MAS支付牌照

- 直布罗陀DLT牌照

- 申请瑞士FINMA牌照

- 立陶宛EMI电子货币牌照

- 立陶宛加密货币牌照

- 美国各州MTL牌照申请的条件和流程

- 新加坡MAS牌照

- 英国AEMI牌照(英国电子货币机构牌照)

- 申请波多黎各银行牌照

- 瓦努阿图离岸银行执照

- 毛里求斯FSC外汇牌照申请流程

- 立陶宛VASP虚拟资产服务提供商许可证

- 安提瓜和巴布达银行牌照

- 多⽶尼加银⾏牌照

多⽶尼加银⾏牌照

Bank Licensing - Dominica

银⾏执照 – 多⽶尼加

About Dominica

关于多米尼克

Dominica's financial sector is primarily handled by commercial banks and insurance businesses. Dominica's beneficial offshore financial

services legislation fosters the formation of quality offshore banks and international enterprises and presents chances for new and creative

investments in all aspects of Dominica's financial services sector.

多⽶尼克的⾦融部⻔主要由商业银⾏和保险公司管理。多⽶尼克有利的离岸⾦融服务⽴法促进了⾼质量离岸银⾏和国际企业的形成,

并为多⽶尼克⾦融服务部⻔的各个⽅⾯提供了新的和创造性投资的机会。

Dominica is a reputable jurisdiction in which to establish an offshore bank. It has a great reputation for protecting consumer privacy due to

strict confidentiality rules, and as a result, it draws a large number of international clients who go on to open a bank account.

多⽶尼加是⼀个信誉良好的司法管辖区,在那⾥建⽴离岸银⾏。由于严格的保密规定,它在保护消费者隐私⽅⾯享有很⾼的声誉,

因此吸引了⼤量的国际客⼾,他们继续在银⾏开⼾。

Geographic Location

地理位置

Dominica is a Lesser Antilles island republic in the eastern Caribbean Sea. It is located between Guadeloupe and Marie-Galante in the north

and Martinique in the south. Since its independence in 1978, the country has been a member of the Commonwealth.

多⽶尼克是加勒⽐海东部的⼩安的列斯群岛共和国。它位于北部的⽠德罗普岛和⻢⾥加兰特岛和南部的⻢提尼克岛之间。

⾃1978年独⽴以来,该国⼀直是英联邦成员国。

Population

⼈⼝

Dominica had a total population of 72.9 thousand people in January 2023. Dominica's population increased by 275 (+0.4%) from 2022 and 2023, according to data.

截⾄2023年1⽉,多⽶尼加总⼈⼝为7.29万⼈。数据显⽰,从2022年到2023年,多⽶尼加的⼈⼝增加了275⼈(+0.4%)。

Language

语⾔

Dominica's national and official language is English, however French and a local French Creole dialect are commonly spoken.

多⽶尼克的国家和官⽅语⾔是英语,但法语和当地的法语克⾥奥尔⽅⾔是常⽤的。

Law

法律

Dominica is a credible jurisdiction for establishing an offshore bank.

Furthermore, Dominica has a great reputation for protecting consumer

privacy due to stringent confidentiality rules, which is what draws many

clients to this country to open a bank account. The Financial Services Unit regulates the Dominica banking industry. Offshore bank licences in Dominica are governed by the Offshore Banking Act 1996 and the Offshore Banking Act 1997, as amended and supplemented throughout time.

多⽶尼加是建⽴离岸银⾏的可靠司法管辖区。此外,由于严格的保密规定,多⽶尼加在保护消费者隐私⽅⾯享有盛誉,这也是吸引许多客⼾到该国开设银⾏账⼾的原因。⾦融服务股管理多⽶尼加的银⾏业。多⽶尼克的离岸银⾏执照受1996年离岸银⾏法和1997年离岸银⾏法的管理,这些法律经过了不断的修订和补充。

Advantages of a Banking License in Dominica

在多⽶尼加持有银⾏执照的好处

1. Offshore Financial Centres 离岸⾦融中⼼

Dominica is recognized as an offshore financial centre, attracting international clientele looking for offshore banking services. This status can give clients with

benefits such as tax planning, asset protection, and privacy.

多⽶尼克是公认的离岸⾦融中⼼,吸引着寻求离岸银⾏服务的国际客⼾。这种状态可以给客⼾带来税收规划、资产保护和隐私等好处。

2. Positive Regulatory Environment 积极的监管环境

Dominica has put in place a regulatory framework that encourages a healthy and secure banking system. Dominica's Financial Services Unit (FSU) regulates and

supervises banks to guarantee compliance with international standards such as anti-money laundering (AML) and know-your-customer (KYC).

多⽶尼加建⽴了⼀个监管框架,⿎励建⽴⼀个健康和安全的银⾏体系。多⽶尼克的⾦融服务部⻔(FSU)负责监管银⾏,以确保遵守反洗钱和了解客⼾等国际标准。

3. Economic and political stability 经济和政治稳定

Dominica boasts a growing and resilient economy as well as political stability. This stability can instill trust in consumers and investors, as well as create a favorable

atmosphere for banking operations.

多⽶尼克拥有⼀个不断增⻓和有弹性的经济以及政治稳定。这种稳定性可以向消费者和投资者灌输信任,并为银⾏业务创造良好的氛围。

4. Geographical Area 地理区域

Dominica's strategic location in the Eastern Caribbean allows it to serve as a gateway to both regional and international markets. This can improve trade and

investment opportunities for Dominican banks.

多⽶尼克在东加勒⽐的战略位置使它成为进⼊区域和国际市场的⻔⼾。这可以改善多⽶尼加银⾏的贸易和投资机会。

5. Access to Global Financial Networks 进⼊全球⾦融⽹络

Dominican banks can form correspondent partnerships with reputable international banks. This facilitates cross-border transactions, access to global financial

networks, and increased trust in the international banking sector.

多⽶尼加银⾏可以与国际知名银⾏建⽴代理伙伴关系。这促进了跨境交易,进⼊全球⾦融⽹络,并增加了对国际银⾏业的信任。

6. Tax Environment That Is Favorable 有利的税收环境

Dominica has a competitive tax framework, including tax breaks and exemptions for offshore banking. This can attract international clients and help the banking

sector grow.

多⽶尼克有⼀个有竞争⼒的税收框架,包括对离岸银⾏的税收减免和豁免。这可以吸引国际客⼾,帮助银⾏业发展。

7. Banking Services of Various Categories 各类银⾏服务

Dominican banks can provide a wide range of financial services, such as retail banking, international banking, trade finance, wealth management, and more. This

variety enables banks to meet a wide range of client needs while also diversifying their revenue streams.

多⽶尼加的银⾏可以提供⼴泛的⾦融服务,如零售银⾏业务、国际银⾏业务、贸易融资、财富管理等。这种多样性使银⾏能够满⾜⼴泛的客⼾需求,

同时也使其收⼊来源多样化。

8. Supportive Government Initiatives 政府的⽀援措施

Dominica's government has shown its support for the development of the financial services industry, particularly banking. They might launch measures to attract

investment, improve infrastructure, and expedite regulatory processes, so creating a favourable atmosphere for banks.

多⽶尼克政府对⾦融服务业,特别是银⾏业的发展表⽰了⽀持。他们可能会出台措施吸引投资、改善基础设施、加快监管流程,从⽽为银⾏创造有利的环境。

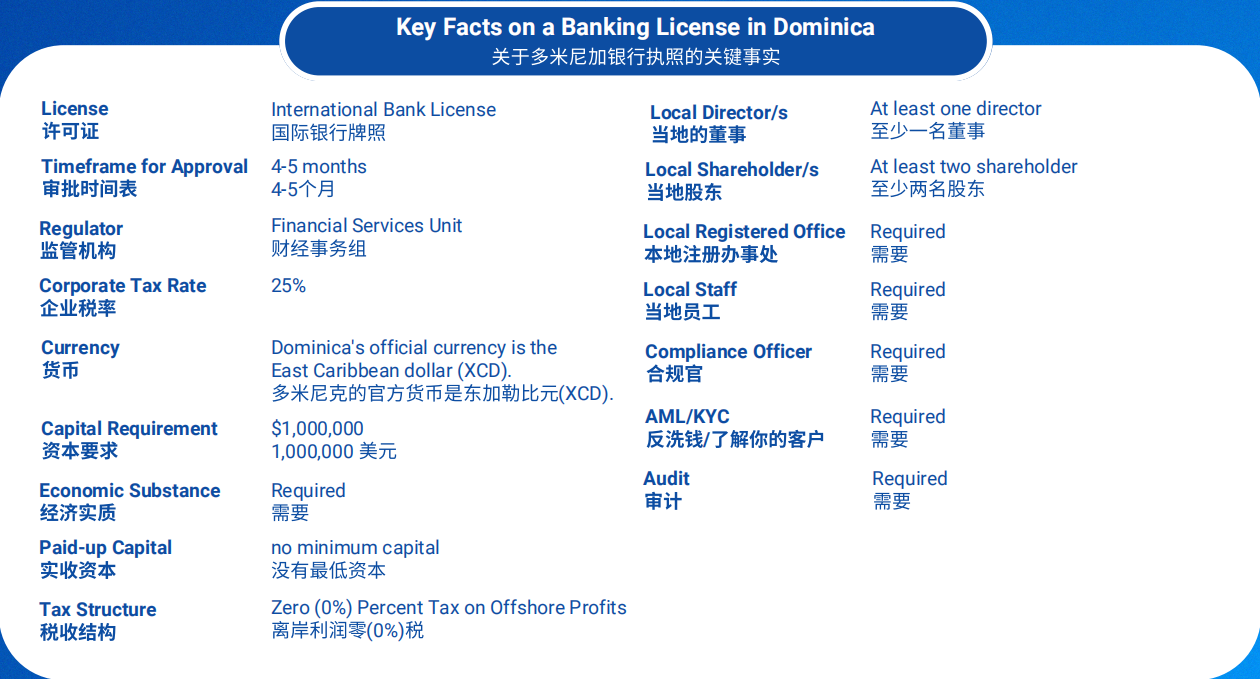

Key Facts on a Banking License in Dominica

关于多⽶尼加银⾏执照的关键事实

Procedure

过程

1. Submitting the necessary paperwork for the formation of a local firm that will apply for a Banking Licence. Following Financial Service Unit

approval, the company can be established.

提交成⽴本地公司所需的⽂件,以申请银⾏牌照。经⾦融服务单位批准,公司⽅可成⽴。

2. Gathering and completing the required Application paperwork for acquiring a Banking Licence.

收集和完成所需的申请⽂件,以获得银⾏牌照。

3. Submitting forms for shareholders' and directors' due diligence procedures.

提交股东和董事的尽职调查表格。

4. The process of document verification begins with submission of all Application documents. Documents are sent to the Ministry of Finance

after they have been verified. The government normally takes three months to review an application after it is submitted.

⽂件验证过程从提交所有申请⽂件开始。⽂件经核实后,送交财政部。申请提交后,政府通常需要三个⽉的时间进⾏审查。

5. Obtaining government confirmation that clearance will be granted.

获得政府的批准。

6. Obtaining the Banking Licence that has been issued.

取得已发出的银⾏牌照。

Other Services

其他服务

Retail Banking Services

零售银⾏服务

International Banking

国际银⾏

Correspondent Banking

代理银⾏

Trade Finance

贸易融资

Payment Services

⽀付服务

Wealth Management and Private Banking

财富管理和私⼈银⾏业务

Investment Banking

投资银⾏

Treasury Services

财政服务

Fiduciary Services

信托服务

Requirements

需求

Documents required by all involved individuals (including but not

limited to directors, shareholders, and beneficial owners):

所有相关个⼈(包括但不限于董事、股东和受益所有⼈)所需的⽂件

Passport copy (Notarized

护照复印件(经公证)

Utility Bill issued within the last 3 months (Notarized)

最近3个月内发出的水电费帐单(已公证)

CV or Resume for each involved individua

每位参与人员的简历或简历

Two professional reference letters

两封专业推荐信

Qualifications (Notarized)

资格(公证)

Business Plan

商业计划

Statements Of Physical Presence

实际存在陈述

Statement Of Financial Relationships

财务关系表

Declaration Of Legal Representative

法定代表人声明

Statement On Bank's Proposed Online Presence

关于银行网上业务建议的声明

Marketing Material Disclosure

市场推广资料披露

For Corporate Shareholders:

公司股东须知

Articles of Association in English

英文公司章程

Registered office address documents (Notarized)

注册办事处地址文件(已公证)

Company Register of director/s

公司董事登记册

Company Register of UBOs (shareholder register, orincumbency certificate, or share certificates)

联合银行公司名册(股东名册,或任职证明书,或股份证明书)

Antigua and Barbuda Banking Licence Package

安提⽠和巴布达银⾏执照包

1. Formation of Dominica International Business Corporation.

多⽶尼加国际商业公司成⽴。

2. Preparation and drafting of shareholder & officer agreements.

准备和起草股东和管理⼈员协议。

3. Preparation and drafting of narrative business plan.

编写和起草叙事商业计划。

4. Prepare five-year financial projections.

准备五年的财务预测。

5. Preparation and drafting of current financial statements.

编制和起草当期财务报表。

6. Preparation and drafting of personal financial statements for owners.

为业主拟备及起草个⼈财务报表。

7. Identification and draft letters naming principal representative and auditor

主要代表和审计师的⾝份证明和信件草稿

8. Draft and prepare required bank charter and prospectus.

起草和准备所需的银⾏章程和招股说明书。

9. Preparation and drafting application with Seychelles Financial Services Regulatory Commission.

与塞⾆尔⾦融服务监管委员会准备和起草申请。

10. Respond and draft responses to Regulator application inquiries.

对监管机构申请咨询的回应和草案回应。

11. Facilitate and consummate bankcard relationships with Visa & Mastercard.

促进和完善与Visa和Mastercard的银⾏卡关系。

12. Preparation and drafting of policy agreements and related documents

政策协议及相关⽂件的准备和起草

13. Facilitate and consummate IBAN/SWIFT and correspondent bank relationship

促进和完善国际银⾏账号/环球银⾏⾦融电信协会和代理银⾏的关系

14. Provide for required physical presence and local director

提供所需的实际存在和当地主管

15. Preparation and review of bank deposit, loan, and related agreements

银⾏存款、贷款及相关协议的准备和审核